Auto Loan Calculator

Calculate payments over the life of your Loan

Home Blog Privacy Terms About Contact

Calculate payments over the life of your Loan

Home Blog Privacy Terms About ContactPublished on October 15, 2025

It all began with a simple comparison. I was looking at hypothetical loan scenarios, just playing with numbers on a website. One option had a monthly payment that seemed incredibly manageable, almost comfortably small. The other had a payment that was noticeably higher, requiring a tighter budget. My immediate, gut reaction was that the lower payment was obviously the better situation. Who wouldn't want more financial breathing room each month?

But then I noticed another number, one I'd often overlooked: the total amount I'd end up repaying. On the loan with the smaller monthly payment, that total figure was significantly larger. It just didn't compute for me. How could paying less each month result in paying thousands more in the end? It felt like a contradiction, a piece of financial math that was designed to be confusing. This wasn't about making a decision; it was about a fundamental gap in my understanding.

This simple observation sparked a deep curiosity. I realized I didn't truly understand the mechanics behind the numbers. I wanted to peek under the hood and see the engine of a loan calculation at work. My goal became singular: to understand the relationship between the loan's timespan—its term—and the total interest that accumulates. I wasn't looking for advice; I was searching for comprehension. This is purely about my journey to understand how these calculations work, not a guide on what financial path to take.

I set out to use online tools not just as magic boxes that spit out answers, but as educational instruments. I wanted to see how changing one variable, the term, could create such a dramatic ripple through all the other numbers. What was happening month-to-month that created such a massive difference over several years? Why was time such a powerful, and expensive, component in this equation?

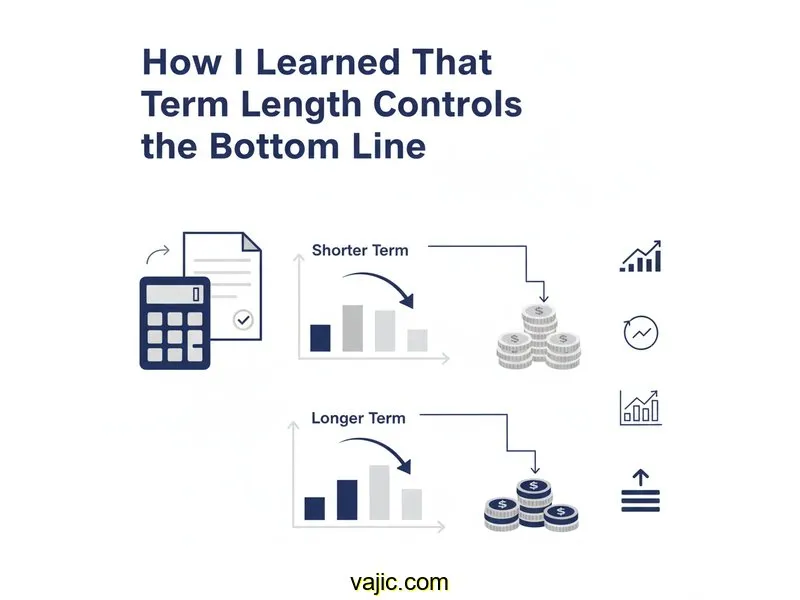

My initial confusion crystalized when I created a specific scenario to test. I imagined a hypothetical loan for $18,350 at an interest rate of 7.8%. I wanted to see the raw numbers side-by-side for a short term versus a long term. I chose 36 months (3 years) and 60 months (5 years) for my experiment.

Using an online calculator, I got the first set of results. For the 36-month term, the monthly payment came out to be approximately $575. My simple multiplication told me that $575 multiplied by 36 months equals $20,700. To find the total interest, I subtracted the original loan amount: $20,700 - $18,350 = $2,350 in interest. That seemed straightforward enough.

Next, I entered the same loan amount and interest rate but changed the term to 60 months. The calculator presented a much lower monthly payment: around $372. This was the number that initially felt so much more appealing. But when I did the same multiplication—$372 multiplied by 60 months—the total repayment was $22,320. The total interest was $22,320 - $18,350 = $3,970 in interest.

I stared at those two bolded numbers: $2,350 and $3,970. The difference was $1,620. Paying $203 less per month would ultimately result in me handing over an extra $1,620. My mind was stuck. I was paying the loan back at the same interest rate, so why was the total interest so vastly different? I felt like I was missing a key piece of the puzzle. My simple math of multiplying payments was correct, but it didn't explain the "why" behind the numbers. The connection between the number of months and the pile of interest was a mystery I was determined to solve.

My frustration led me away from simple payment calculators and toward something more detailed: an amortization schedule generator. This was the tool that changed everything. Instead of just giving me the summary—monthly payment and total interest—it showed me a complete, month-by-month breakdown of every single payment over the entire life of the loan. It was like finally getting to see the raw data instead of just the conclusion.

I generated two schedules, one for the 36-month scenario and one for the 60-month scenario. By placing them side-by-side, the abstract concept of "interest" became a tangible, visible thing. I could see exactly how much of my $575 payment (in the 36-month case) versus my $372 payment (in the 60-month case) was going toward the interest and how much was actually chipping away at the $18,350 principal. This visual evidence was my breakthrough moment.

The most shocking revelation from the amortization schedule was seeing how interest is "front-loaded." In the 60-month scenario, my very first payment of $372 was composed of roughly $119 in interest and only $253 in principal. A huge chunk of my money wasn't even touching the original loan amount. Over a third of my payment vanished to interest. In contrast, the first payment of $575 on the 36-month loan was about $119 in interest and $456 in principal. I was clearing the actual debt much faster.

My next realization was that the term—36 months or 60 months—wasn't just a deadline. It represented the number of times the bank would calculate interest on my remaining balance. The 60-month loan provided 24 extra opportunities for interest to be generated. Because the principal balance went down much more slowly, the interest calculated each month remained higher for longer, causing the total interest to pile up.

I started to see each monthly payment as a sliding scale. At the beginning of a long loan, the scale is heavily tilted towards interest. As you pay down the principal over many months, the scale slowly slides the other way, and more of your payment goes toward the principal. A shorter loan term forces that scale to slide much, much faster, saving you from paying all that front-loaded interest over a prolonged period.

To be sure this wasn't a fluke, I ran more tests. I tried a hypothetical $12,500 loan at 6.5% for 48 months versus 72 months. The pattern was identical. The 72-month loan had a seductively low monthly payment, but the total interest was thousands of dollars higher than the 48-month option. My confusion was gone, replaced by a clear understanding of the mechanics. Time wasn't just a passive element; it was an active ingredient in the recipe for total interest.

This deep dive into loan terms was incredibly revealing. I moved from a place of confusion to one of clarity simply by engaging with the numbers and the tools designed to explain them. Here are the key lessons I took away about the mechanics of these calculations:

From what I've learned, it's because the lower payment is achieved by stretching the repayment over a longer period. Each additional month is another cycle where interest is calculated on your remaining balance. So, while you pay less each month, you make many more payments, and a larger portion of those payments goes to interest rather than reducing the principal.

I found that the most effective tool for this is an amortization schedule calculator. It generates a detailed, month-by-month table that explicitly breaks down each payment into its principal and interest components. This lets you see the numbers for yourself instead of just relying on a summary.

The term dictates the number of compounding periods. A loan with a 60-month term will have interest calculated on the outstanding balance 60 times. A 36-month term will have it calculated only 36 times. Because the principal on the longer loan decreases more slowly, the interest charges in the early and middle phases are consistently higher, leading to a greater total accumulation.

Yes, this is another great use for an amortization schedule. You can scroll down the payment list and find the "crossover point"—the exact month where the principal portion of your payment finally becomes larger than the interest portion. On longer-term loans, this point occurs much later.

My journey through these numbers left me with one profound takeaway: in the world of loans, time is a powerful multiplier. The length of a loan term isn't just a matter of convenience; it is a fundamental component of the mathematical formula that determines how much interest you will ultimately pay. My initial confusion came from looking at only one piece of the puzzle—the monthly payment. I learned that to understand the whole picture, you have to look at the term and the total interest together.

Playing with calculators and, most importantly, learning to read an amortization schedule, transformed these concepts from abstract financial jargon into concrete, understandable mechanics. It was an empowering process that replaced mystery with math. I'd encourage anyone curious about these topics to do the same. Use the tools not just for answers, but for understanding.

This article is about understanding calculations and using tools. For financial decisions, always consult a qualified financial professional. My exploration was for educational purposes, to satisfy my own curiosity and build my confidence with the numbers that shape our financial world.

Disclaimer: This article documents my personal journey learning about loan calculations and how to use financial calculators. This is educational content about understanding math and using tools—not financial advice. Actual loan terms, rates, and costs vary based on individual circumstances, creditworthiness, and lender policies. Calculator results are estimates for educational purposes. Always verify calculations with your lender and consult a qualified financial advisor before making any financial decisions.